What is crowdfunding?

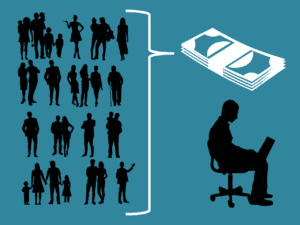

Crowdfunding is a tool for raising small amounts of capital for the funding of a venture from a large number of investors. This is usually accomplished via the internet and social-media driven platforms. Crowdfunding is a means for entrepreneurs to expand their capital beyond the initial pool of investors, such as funding from their own resources and those of friends, family and venture capitalists. This tool is commonly found in the early stages of development of a new venture, those of pre-seed and seed.

Crowdfunding affords the investor a sense of investment in the product or service they are funding. It also grants them a sense of agency, as they may disseminate products in which they believe to friends and family. Crowdfunding also often grants an investor early access to a product or service.

Our law offices in Tel Aviv and Jerusalem specialize in Israeli company law. Our attorneys can help you with all stages of establishing, registering and financing of your business.

Types of crowdfunding

There are different types of crowdfunding. Reward-based crowdfunding involves the pre-selling of a product or service by entrepreneurs. This allows the entrepreneur to do so without incurring debt or providing equity. This is also called non-equity based crowdfunding.

There are different types of crowdfunding. Reward-based crowdfunding involves the pre-selling of a product or service by entrepreneurs. This allows the entrepreneur to do so without incurring debt or providing equity. This is also called non-equity based crowdfunding.

As the name implies Equity crowdfunding enables the investor to receive a return on their investment through the offering of shares in the company.

Debt-based crowdfunding is a process by which borrowers apply online, usually for a fee, and an automated system evaluates their credit risk and interest rate. This goes under several names, such as “crowdlending” or “peer to peer lending”. Via this process, investors buy securities in a fund which makes loans to borrowers and, in return, may reap interest on their unsecured loans.

Initial coin offering (ICO) is an unregulated means to raise capital for cryptocurrency.

Regulation of crowdfunding

Crowdfunding is a regulated industry. In Israel, there is a cap on the amount an investor may invest in a single venture and on the cumulative number of investments they may make in a given year. This amount varies from investor to investor, based on personal income.

To be exempt from issuing a prospectus or from the need to disclose information to the public under Israel securities laws, a company must be incorporated in Israel and be duly licensed to operate the crowdfunding platform, known as an Offering Coordinator.

Only corporations that prove that they have the technical know how to operate a crowdfunding platform will receive a license to do so. They must also pay a fee, adopt certain measures and put down a deposit of ILS 100,000. An Offering Coordinator is limited to raising capital or debt in the amount of ILS 4 million per year, with the possibility of raising this amount to ILS 6 million under certain conditions.

In the United States, the Jumpstart Our Business Startups Act (or JOBS Act for short) was enacted in 2012 to encourage additional methods for small businesses to raise capital. A key provision involves the allowing of companies to issue securities, including through the internet, without the need for a prospectus. This overturned decades of more stringent regulations by the Securities and Exchange Commission, in which companies were prohibited from issuing securities as a source of crowdfunding.

Please contact us for help with all your financing needs.

מאמרים מומלצים